Are Travel Insurance Premiums Tax Deductible

You do receive other tax benefits as a homeowner but they are not related to homeowners insurance. Insurance premiums are among the most frequent types of expenses that taxpayers deduct in a statement.

Understanding An Insurance Policy Is An Easy Task Now For More Interesting Facts On Insurance Stay Tuned To Our Page Insurance Takeapolicy Insurancefacts

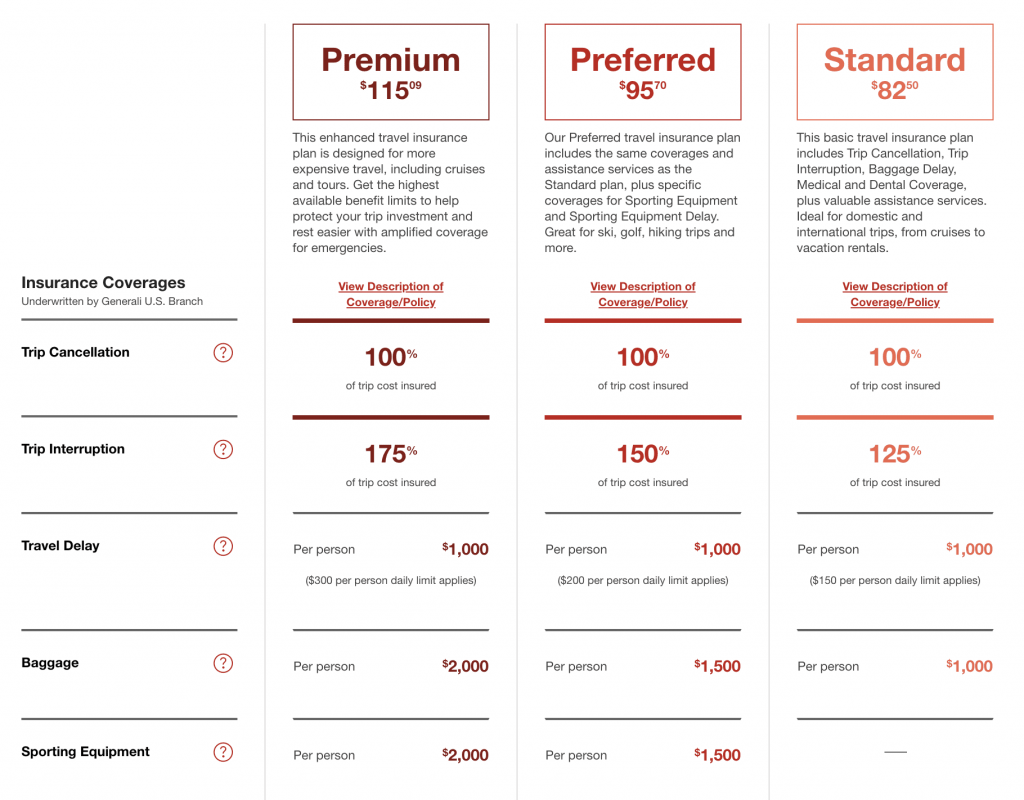

Other types of travel insurance like trip cancellationinterruption insurance and baggage insurance are not eligible for Medical Expense Tax.

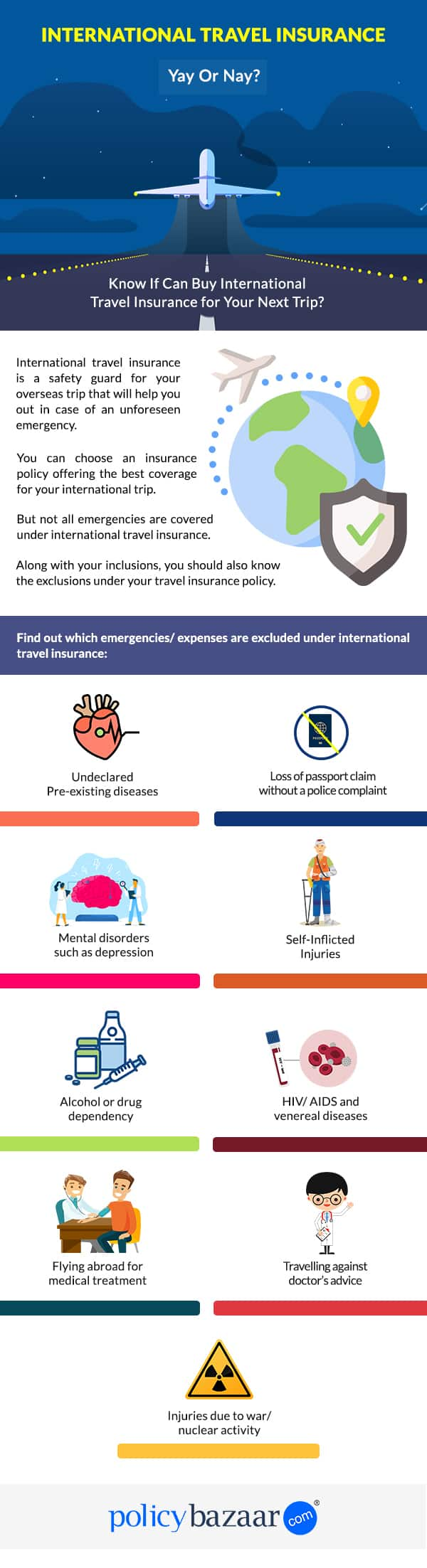

Are travel insurance premiums tax deductible. However they are not tax deductible if you your spouse or your dependents are covered by another employers group health insurance plan. Most people cant deduct their Medicare premiums pre tax unless theyre self-employed. Only travel medical insurance is eligible to be claimed.

The Inland Revenue Amendment No. For LLCs While the IRS allows LLCs to deduct most of the insurance premiums associated with business expenses life insurance premiums are not eligible. If you are self-employed you may use a part of the travel health insurance as a tax deduction.

Its important to note while travel medical insurance is tax-deductible trip cancellation or interruption insurance is not. You may not deduct premiums for trip cancellation or other types of travel insurance. If you are employed you may use a portion of the premium that is used to pay for emergency medical coverage.

Are Health Insurance Premiums Pre-Tax. You can deduct your health insurance premiumsand other healthcare costsif your expenses exceed 75 of your adjusted gross income AGI. If it is not then you are unable to have your income protection premiums deducted as.

Premiums refer to the monthly or annual fees youpay tohave insurance Thanks to Canadas Income Tax Act ITA deductibility of insurance premiums is a complicated maze of specific rules for specific scenarios. Medicare expenses including Medicare premiums can be tax deductible. Self-employed people make up the majority of those who may deduct their car insurance premiums but theyre not the only ones who qualify.

Income protection Insurance Your income protection insurance premiums are tax deductible provided a benefit payout that you claim on your policy is regarded as a taxable income. There are however some instances where you can deduct a portion of your travel insurance premiums from your payable tax amount. Your insurance premiums are not tax deductible except under special circumstances.

An example of insurance premiums that are non-deductible is those relating to group insurance which provides for a cash surrender or investment saving value. The premiums you pay to cover yourself and your dependents can be tax deductible. If you have an all-inclusive policy only the portion of the policy that covers medical coverage is deductible.

Below is a summary of the premiums currently deductible in the tax returns. Whether or not your insurance premiums are tax deductible depends on your own or your companys specific tax situation. Tax Deduction for Qualifying Premiums Paid under the Voluntary Health Insurance Scheme VHIS Policy.

You cant deduct the premiums you paid for your health insurance in 2019 on your 2019 tax return. If you buy a comprehensive travel insurance policy you may only deduct the portion of the policys premium related to travel medical insurance. In fact in Ontario you can claim a wide range of medical expenses.

Make sure you speak to your accountant to get professional advice on claiming your travel medical insurance premium as a Medical Expense Tax Credit. Consult the ATO website or your tax adviser for more detail on each of the methods. That being said your premiums may be tax-deductible if youre using life insurance as a way to protect your business assets like an office space or other capital.

Such expenses are incurred to acquire a capital asset and are not tax deductible. If youre a landlord or a homeowner who uses part of your home for business purposes you may be able to deduct a portion of your homeowners insurance. 8 Ordinance 2018 was enacted on 9 November 2018.

The deduction is prohibited because coverage was available to you through your spouses employer even though you didnt participate in it. However the maximum amounts of expenditure that can be deducte have decrease significantly in recent years. For example reservists in the armed forces who travel up to 100 miles from home can deduct their auto insurance premiums as can qualified performing artists and fee-based state or local government officials.

Claiming your health insurance as a deduction will help to. Health insurance premiums are an eligible tax deduction Many people dont realize that health insurance premiums are tax-deductible. The cents per kilometre method incorporates all costs so there is no separate deduction for car insurance if you use this method.

However the amount that can be deducted is subjected to the age-based limits as set for individual taxpayers. The amendment ordinance gives effect to a tax deduction under salaries tax and personal assessment to taxpayers who pay qualifying premiums under a Certified Plan. You can deduct all medical expenses that are more than 75 percent of your adjusted gross income.

In the meantime here are a few things to keep in mind about Medical Expense Tax Credits. If you use the log-book method you can generally claim the work-related percentage of your car insurance as a deduction.

Pin On International Travel Insurance Tips

What Does National Travel Insurance Policy Cover Insurance Policy Travel Insurance Personal Insurance

Are My Travel Insurance Premiums Tax Deductible

Choosing Travel Insurance Reviews Costs Best Providers

Are Health Insurance Premiums Tax Deductible Insurance Deductible Medical Insurance Health Insurance

Save Your Tax By Buying Religare Health Insurance Health Insurance Health Insurance Plans Cheap Health Insurance

Travel Insurance Claim Procedure Future Generali

International Travel Insurance Online Buy Overseas Travel Insurance Policy