Air Travel Accidental Death Insurance

If the travel injury sustained due to the aircraft accident results in the death of the insured traveler in the severance of a limb or in irretrievable loss of eyesight speech or hearing the Accidental Death Dismemberment Air Flight Only coverage will pay the largest amount of the following benefits. What Flight Accident Insurance Covers This type of trip insurance is limited to death dismemberment and blindness.

Travel Medical Insurance The Complete Guide Tir

The international insurance coverage can be purchased for common carrier air travel bus travel etc flight only or 24-hour coverage.

Air travel accidental death insurance. Search on our site. What is Accidental Death Insurance. See the full explanation of Accidental Death and Dismemberment coverage including the policy limits for each travel insurance company.

The accident must happen while you are boarding traveling in or disembarking from the airplane The loss must be a direct result of an accident and must occur within a certain number of days usually 180-365 of the accident. The 24 hour accidental death coverage applies 24 hours a day when traveling. Flight accident ADD this protection provides coverage in the event you are injured or lose your life while riding as a passenger in an aircraft.

Accidental Death Dismemberment plans are similar to a life insurance policy in that you would name a beneficiary upon purchasing your travel insurance. In the event of death or dismemberment while boarding flying or disembarking the policy provides a lump-sum benefit. High-Limit Travel Accident Insurance plans.

Aviation accident insurance covers injuries sustained by pilots as well as travelers with the type of coverage typically accidental death and dismemberment. Flight accident coverage is one of the types of insurance that most people never want to think about. Of the Air Mobility Command of the United States or a similar type service of any other recognized country TRAVEL ACCIDENT For pedestrians and private passenger automobile travelers benefits are reduced by 50 for accidents that occur on or after any insured persons 70th birthday.

Ad Find all you need to know on your search. Its as easy as that with MySearchExperts. That person would receive the benefit in the event of your death or dismembering injury while traveling.

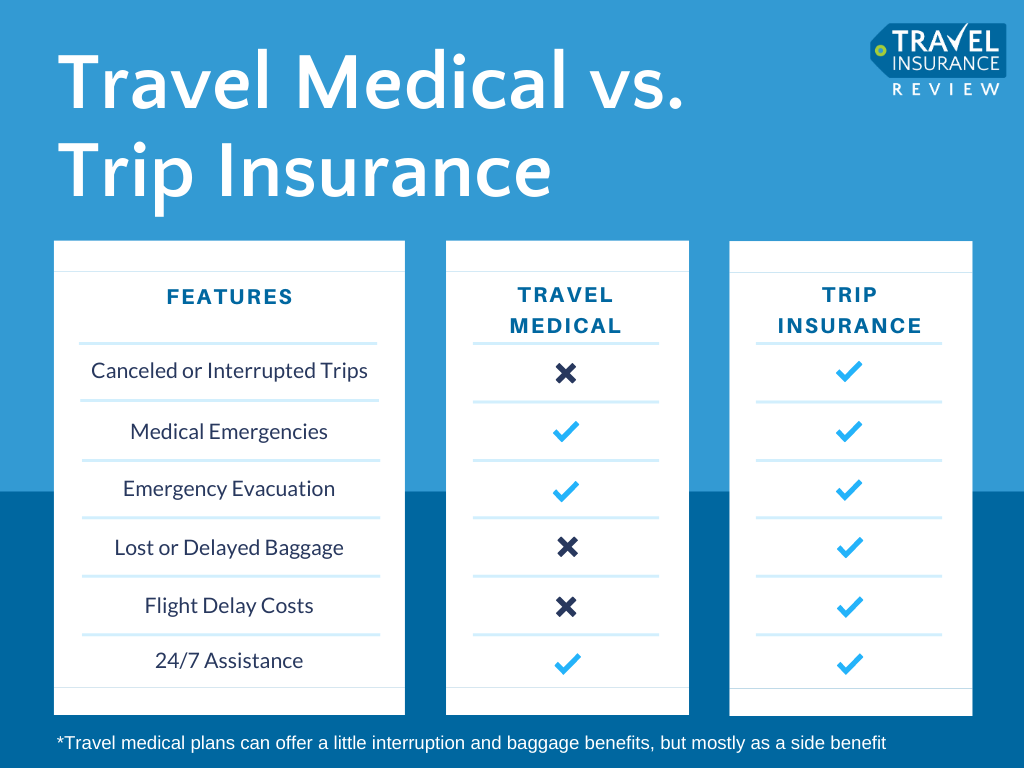

Flight accident insurance common carrier accident insurance andor 24-hour accidental death insurance pays you or your beneficiary a lump sum benefit for example 1 million when an accident results in your death the loss of a limb. GROUPROTECTORSM TRAVEL ACCIDENTAL DEATH INSURANCE. Accidental death and dismemberment coverage is usually offered by trip protection package plans and travel medical plans and it can sometimes be purchased as an optional upgrade.

Search on our site. Flight Guard is accidental death and dismemberment insurance which provides you coverage for the duration of your trip while you are flying on commercial airlines. High-Limit Travel Accident Insurance is designed to provide supplementary coverage in the case of an accidental death or dismemberment while traveling internationally.

Accident Insurance Pays the Principal Sum Benefit to the designated beneficiary in the event of death due to accidental bodily injury or exposure to weather as a result of an accident or disappearance or the sinking of a conveyance on which the insured was a passenger and the body is not found within 365. Youre covered for any regularly scheduled commercial flight Your beneficiary -ies can include your estate family members friends organizations etc. The flight only or common carrier accidental death coverage will only apply when you are on an airplane or in a common carrier such as a cruise line or motor coach.

This type of coverage provides them with accidental death insurance in the unlikely event that they do not survive a plane crash. Please note that such coverage typically excludes emergency medical evacuations and repatriation of remains. Death benefits are paid paid at 100 of the policy limit.

The ADD plan you purchase will come with a Table of Losses which details benefit amounts in. Its as easy as that with MySearchExperts. It also covers boarding and alighting from aircraft.

This is affordable coverage that should be considered with every flight you take. Access all the information you need. Accidental death flight insurance or ADD Common Carrier Air Only provides coverage for any injury or death sustained while boarding riding on exiting from being struck by or run down by an aircraft.

Not everyone in this situation has a life insurance policy in place before they travel but they can purchase flight insurance that will cover them while they are in the air. Maximum allowable Flight Accident Coverage is 1000000 per traveler per covered trip. Ad Find all you need to know on your search.

Access all the information you need. Each traveler can get 1 million maximum no matter how many beneficiaries there are.

What Is Flight Insurance And Do I Need It Your Aaa Network

Life Medical Accident Insurance Protection Policy Pictogram 765253 Icons Design Bundles In 2021 Accident Insurance Best Insurance Insurance

Flight Only Ad D Coverage Squaremouth

What To Know About Ad D Insurance Forbes Advisor

Travel Medical Insurance The Complete Guide Tir

International Travel Medical Insurance For Short Term Travel

Flight Accident Coverage Flight Accident Insurance

Best Online Travel Insurance Get More Benefits Travel Insurance Online Travel Safe Travel

What Your Travel Insurance Covers Travel Insurance Best Travel Insurance Traveling By Yourself