Are Travel Vaccines Tax Deductible

You can claim for treatment abroad that is also available in the State but you cannot claim travelling expenses for this care see below. You will need a WHO Yellow Vaccination Passport if you plan on traveling internationally once borders open.

Mileage Reimbursement Form Template Inspirational 26 Sample Claim Forms In Word Template Word Templates Elementary Lesson Plan Template

You should consult a health care provider or visit a travel health clinic preferably six weeks before you travel.

Are travel vaccines tax deductible. See ATO ID 2002775 for an example. If your employees travel for your business the business must actually pay for the travel expense to be able to claim it as a deduction. Right now things like meals and entertainment expenses for businesses are non-tax deductible.

Between the date of enactment and Dec. If you take the family on a trip and meet with a client for dinner one night the dinner with the client is deductible but the. If your doctor certifies in writing that you need an attendant to help you travel you may also deduct your attendants traveling expenses.

This is an opportunity to. You can claim a deduction for medical travel if you have an amount in box 33 of your T4 slip or box 116 of your T4A slip showing any taxable travel benefits you received in the year. Review your immunization history.

These rules apply to workshops conferences and seminars as well as actual conventions. There are deductions associated with business travel but the IRS distinguishes between business and pleasure. Paying directly for the expense from the business account.

You cant however rent a hotel room within a reasonable distance of your home even if youd spent the day at a conference at a nearby hotel and expect to write it off. Theres a proposal in Congress to give you an Explore America tax credit of 4000 or more to cover travel expenses. Any work assignment in excess of one year is considered indefinite.

Certainly not for vaccinations available to the general public. When travelling outside Canada you may be at risk for a number of vaccine preventable illnesses. This operates in the same way as the health insurance tax credit.

You may also deduct airfare if. The business can pay for the expense by. Example EIM34004 Travelling expenses.

You must travel at least 80 kilometres away from your home. In order to qualify. Travelling abroad for treatment.

Unfortunately that contribution wont be tax deductible even though political campaigns are considered nonprofit organizations. Expenses that may be deducted. You can claim tax relief on the cost of medical treatment you get outside the State.

While you may conduct business in your town only your standard mileage rate and meals assuming you dine with business contacts are deductible. Vaccinations are private in nature. Public transportation vs driving.

They are RARELY deductible. Travel and lodging Mileage 17 cents per mile taxi fare bus or ambulance transportation for traveling to see a doctor or specialist is deductible. The medical services you receive must not be readily available near your home AND.

Will Uncle Sam Pay You to Take a Vacation. How to claim employee travel expenses. The CDC in mid-May quietly changed its international travel recommendations to require fully vaccinated people to test negative for COVID-19 before flying to the United States.

You can deduct your travel expenses including travel lodging and meals for yourself when you attend a convention within the United States if you can show that attending the convention benefits your business. However exceptions do exist. Make sure your provincialterritorial vaccination schedule is up-to-date.

Travel Tax Credit. Travel Association proposes a tax credit worth 50 of qualified travel expenses incurred in the US. In its legislative priorities document the US.

Convention expenses may be deductible. You can deduct travel expenses paid or incurred in connection with a temporary work assignment away from home. For tax years after 2017 generally entertainment expenses are no longer deductible.

The medical services had to be for you or a member of your household and must not have been available where you lived. However you cant deduct travel expenses paid in connection with an indefinite work assignment.

Pin By Topwalid On Divers Data Dashboard Key Performance Indicators Business Intelligence

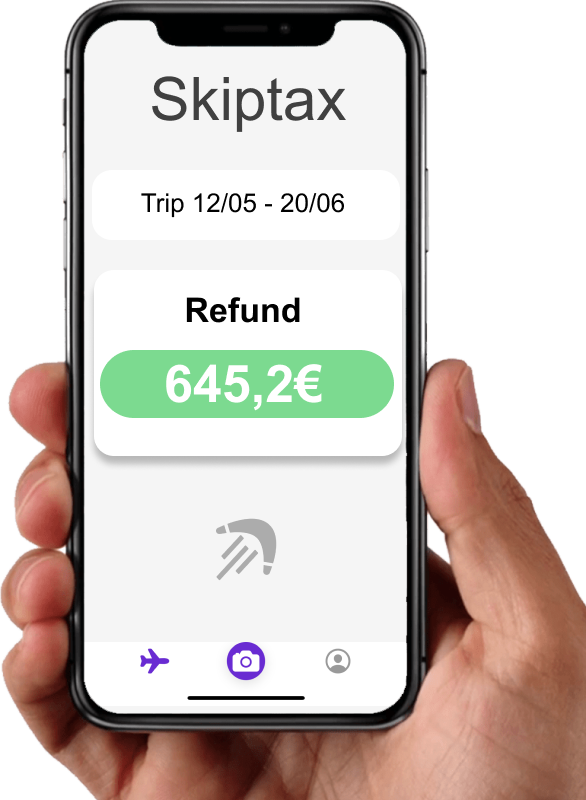

France Finally Welcomes Vaccinated Americans Skiptax Official Tax Refund

Pv Solar Water Heating Demonstration Program Solar Water Heating Solar Water Solar Pv

Indonesia Accelerates Tax Reforms Cuts Corporate Income Tax In Covid 19 Playbook Business The Jakarta Post

France Finally Welcomes Vaccinated Americans Skiptax Official Tax Refund

Income Tax 2020 Everything You Should Claim As Income Tax Relief News Rojak Daily

Home Skiptax Official Tax Refund