Are Travel Protection Plans Worth It

For example if your flight is cancelled youre generally entitled to. But the best reason to not buy a protection plan is if the math doesnt make purchasing a plan worthwhile.

The 3 C S Of Filing A Travel Insurance Claim Travel Travelinsurance Wanderlust Travel Insurance Travel Insurance

Americans spent nearly 38 billion on travel protection in 2018 the latest figure available up about 41 percent from 2016 according to the US.

Are travel protection plans worth it. Will the waiver fee end up being significantly less than an airline change fee. Should you buy Expedia Travel Insurance when traveling internationally you will have woefully weak protection. Two key questions to ask are.

Weve used criteria to obtain a quote for a traveler age 35 traveling for 1 week to Mexico on a trip costing 3000. We offer a number of low-cost travel protection plans but the iTI Lite plan gains most interest. You wont have trouble purchasing some level of coverage regardless of your situation.

Imagine investing in a cruise package for 4000 or a safari for 12000 or even airfare for your family of six for 2800. If your trip is delayed by the airline plans will offer you generally around 250-300 to cover select eligible expenses. Plans earned points for also offering cancel for any reason coverage which allows cancellation for any reason including fear of traveling.

Allianz Travel offers 2 core types of travel insurance plans. Right now Priceline has the best ticket price on a US Airways flight to and front TC for the needed timedate. But note how robust it is when compared to the plan offered by Delta.

For instance a travel insurance policy that only covers lost luggage is probably not worth it if you only travel with carry-on bags. Additionally there are travel insurance comparison websites that make it easy to find a policy that fits and purchase coverage that is effective immediately. But there are important differences worth knowing.

Travel insurance is widely available and competitive. All plans include all of the expected package benefits plus 24-hour emergency assistance services including a unique Consult a Doctor service that puts worried. But the basic policies are usually not worth your money to insure just your flight if you know your rights as a passenger.

For example a plan that will insure a trip worth 150000 can reimbursement more for CFAR than a plan with a trip maximum of 50000 assuming. In our research we found prices ranging from 50 to 128 so whether or not a vacation waiver is worth the cost depends very much on your individual plans. TripMate Media 2016-07-28T192314-0500 A travel protection plan is a package of benefits and services intended to protect your travel investment your belongings and most importantly you.

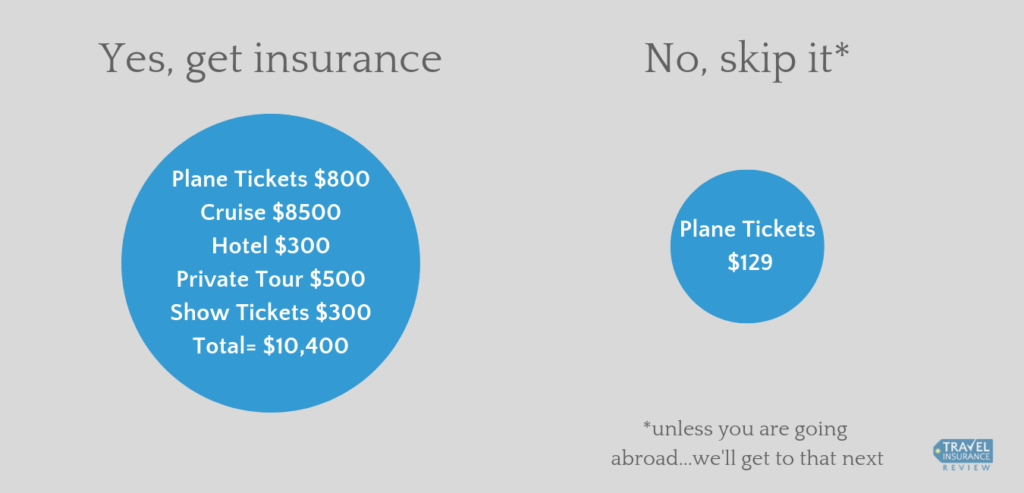

Travel insurance is smart when your pre-paid and non-refundable expenses are more than you are willing to lose. It generally adds about 40 to the travel. But for the coverage to kick in the delay has to be six or sometimes 12 hours or more before you can expense items like accommodation and meals.

All travel insurance policies are not created equal and some may not include the type of coverage you want or need. Each plan allows you to select the level of coverage you want and subsequently the level of premium you prefer to pay. The average cost of the protection plan is.

All benefits are per person per trip unless otherwise noted. Any of those losses would hurt if you needed to cancel. CSA Travel Protection now Generali offers a limited set of travel protection plans which makes it easy to choose the one right for you.

Single trip plans and multi-trip plans. Editor Review of CSA-Generali. The Value of Travel Insurance Comparison Websites.

Travelers who want to protect their trip may be considering insurance and tempted to buy a less expensive waiver or trip protection plan. I have no way of predicting the future so for the first time I am looking into trip insurance to cover the flight in the event that I have to cancel the airfare tickets. Its usually not worth it to buy insurance for short inexpensive domestic trips.

ITI RoamRight and TII all have great value trip insurance plans for around 20. Again AIG Travel Guard will not call it Travel Insurance on its policy documents. Travel Delay Coverage.

There are so many weaknesses in this policy. Travel protection provides many benefits here are a few. Now for those.

I will be booking airfare in late November for me and another to TC and my father is ill. This time it is known as a Flight Total Protection Plan. These plans are pushed as good sensible buys but they actually provide pretty thin coverage and most travelers dont risk much skipping it.

It is certainly low-cost only 19. With receipts this benefit tops out at 150 per 24-hours.

How Can You Tell If You Have Primary Or Secondary Coverage Check Out This Infographic To Help Distinguish Betwe Travel Insurance Infographic Medical Insurance

Check Out These Travel Insurance Facts Travel Benefits Insurance Facts Health Insurance Infographic

Travel Infographic Use A Travel Agent To Book Your Next Vacation To Enhance Your Trip Save Money Infographicnow Com Your Number One Source For Daily Travel Agent Marketing

When Is Travel Insurance Not Necessary Travel Insurance Review